In the recent annual report of the company N Chandrasekaran stated that the global geopolitical environment remains strained because of ongoing military conflicts which continue to disrupt supplies chains He highlighted positive signs of stabilization despite these challenges Global growth is projected to be a constant 3% in the coming years The markets are beginning to recalibrate amid the turmoil which signals a more optimistic outlook

- Read More:

- Assessing the Future: Ministry of Road Transport & Highways Evaluates Automobile Industry Readiness

Tata Motors Resilience and Performance

Tata Motors successfully navigated through these challenges and emerged stronger despite the headwinds The company successfully transitioned from the BS VI Phase 2 emissions standards to India more stringent BS VI Phase 2 standards and its Jaguar Land Rover division (JLR) commercial vehicles (CV) and passenger vehicles (PV) divisions made remarkable progress in critical areas Tata Motors has made significant progress in key metrics such as brand perception customer satisfaction and financial performance Product innovation employee engagement and product innovation have also seen impressive improvements

Financial Milestones

Tata Motors has achieved unprecedented financial milestones and set new records for performance Tata Motors net revenue for the year soared from Rs437928 to Rs62798 crore Profit before taxes (excluding exceptional items) reached a solid Rs28932 billion while auto free cash flow remained strong at Rs26925 billion These figures highlight the company resilience and growth in terms of financials and mark a year that was marked by operational success and strategic execution

Debt-Free India Operations

Tata Motors India is now debt-free This is a remarkable achievement which demonstrates the financial strength of the company Tata Motors with its ambitious plans to eliminate Jaguar Land Rover debt by FY25 is strategically positioned to take advantage of emerging opportunities within the rapidly evolving electric car market and the increasingly connected automotive ecosystem The company’s strong financial position allows it to take the lead in shaping the future mobility

Take advantage of Industry Shifts

N Chandrasekaran said With Tata Motors remarkable turnaround this company now embraces these industry shifts with unparalleled strength and confidence Tata Motors can now capitalize on transformational trends and reinforce its leadership position in the changing automotive landscape

Commercial Vehicle Segment Returns

N Chandrasekaran the top executive at Tata Motors emphasized that the commercial vehicle segment (CV) made a strong comeback in FY24 The unit achieved an impressive revenue growth of 11.3% over the previous year with a total of Rs78 791 billion Profit before tax (excluding extraordinary items) soared by almost 90% to Rs6102 billion This strong performance highlights CV ability to grow in a dynamic industry

Expanding Growth Avenues

Tata Motors CV segment is exploring new growth opportunities beyond its core strengths which include heavy and intermediate trucks as well as small commercial vehicles, busses and international markets The company is focusing on high potential growth areas such as enhancing its non vehicle service (spares maintenance) developing smart mobility solutions for urban electric vehicles and creating a cutting edge digital ecosystem that optimizes trucks and trips These initiatives which are geared towards the future position the CV unit to be a leader in innovation and commercial mobility

The Indian CV Market has a long-term potential

Chandrasekaran emphasized the enormous long term potential for the Indian CV market by drawing parallels with its growth trajectory and the nation growing GDP He highlighted Tata Motors commanding position in the sector Citing its decades-long market presence unmatched brand awareness technological excellence and a wide range of vehicles he cited Tata Motors dominance He noted that these strengths uniquely position Tata Motors to take advantage of the growing opportunities in India commercial vehicles landscape

Robust Business Model with Future Focus

The CV unit is based on a solid business model that delivers healthy margins and high operating leverage The focus of the future will be to drive accelerated revenue growth and increase EBITDA while generating a solid free cashflow This strategy is based on continued investment in cutting edge technology reinforcing the brand leadership and ensuring that the CV unit stays at the forefront of innovation and profitability

Diversification beyond traditional sales

Chandrasekaran stressed that Tata Motors strategy is based on diversification which goes beyond traditional vehicle sales Tata Motors wants to reduce the volatility in vehicle sales by expanding its reach to high-margin sectors like digital solutions smart mobility services and spare parts This multifaceted strategy is designed to ensure steady growth and value addition so that the CV segment can continue to thrive in the future

Electric Bus Initiatives and Electric Bus Financing

Tata Motors drive to diversify within the CV sector has been further highlighted by its expanding ebus initiatives The company supplies electric buses on a gross cost contract (GCC basis) to various state transportation units The company has made significant progress in its electric bus plans and three subsidiaries have successfully secured a total of Rs 837 crores for long term funding to support the GCC projects Tata Motors is a pioneer in the asset light model for this sector giving priority to operational efficiency and not direct ownership of e buses This strategic approach enhances flexibility and positions the company as an industry leader in sustainable transport solutions

Record sales of passenger vehicles

Tata Motors passenger vehicle division (PV) has now won three years in a row according to Chairman N Chandrasekaran For the third consecutive year the unit reached record sales with a staggering 573541 vehicles a 6% increase from year to year Retail sales grew by an astounding 8.4% based on Vahan data compared to the FY23 Tata Motors is committed to innovation and excellence in the highly competitive passenger car market

Commitment to Clean Technologies

Tata Motors has achieved impressive results with its strategic focus on clean technologies such as CNG or electric vehicles These segments now represent a significant 29% of their overall portfolio The company impressive market share of more than 70% has helped it cement its leadership position in the Indian EV sector Tata Motors has achieved a milestone by producing over 150000 EVs an accomplishment that is shared only by a few select global automakers In FY24 the company saw EV sales increase by 47.5% over last year to 73844 vehicles This reflects its unwavering commitment towards sustainable mobility

The SUV Market Leaders

Tata Motors is proud to have the two most popular SUVs in India the Nexon and Punch The passenger vehicle division (PV) which has a revenue of Rs 52353 crores is also a milestone This represents a 9.4% increase compared to the FY23 Profitability improved by 100 basis points with EBIT margins increasing The PV business also maintained a positive cash flow highlighting its strong financial health and operational efficiency

The PV Market has a Long-Term Growth Prospect.

Chandrasekaran sees a substantial growth potential for the Indian passenger car market in the future The market is expected to surpass the milestone of five million units sold in the next few years India is the second largest automotive market in the world but it still trails China by a considerable margin China market size which is six times larger has a market that is twice as large. India’s vehicle penetration rate is well below the global average at 30 vehicles per 1000 inhabitants This presents a huge opportunity for expansion in the future. Tata Motors which is positioned strategically to take advantage of this potential and increase its market share in this rapidly growing landscape is aiming to do so

PV business priorities

The PV business has identified its top priorities for the future including outpacing the market improving EBITDA maintaining positive free cash flows elevating the customer experience and strengthening both brand and technology leadership The company is committed to investing in advanced platforms cutting edge electrical and electronic architectures and sophisticated vehicle software as the competition increases Tata Motors will also place a high priority on improving customer satisfaction and product quality to ensure that it not only meets but exceeds the expectations of their valued customers

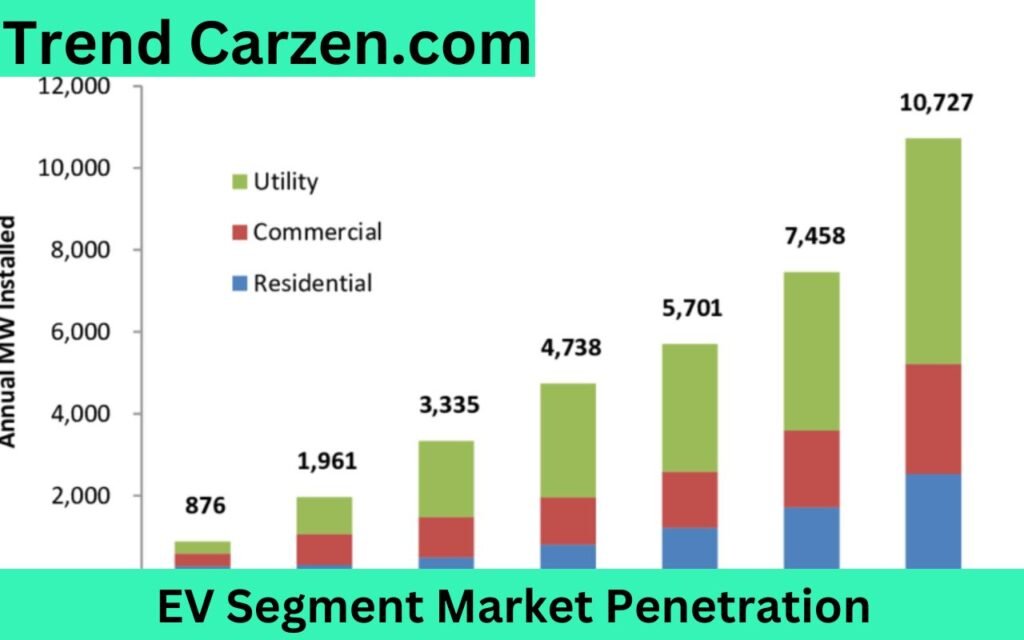

EV Segment Market Penetration

The EV segment is going to place an emphasis on penetration of the market through targeted product launches and dynamic market development programs as well as ongoing improvements in charging network infrastructure The company also aims to add even more features that are aspirational into its EV line up which will enhance the overall customer experience and drive greater interest in sustainable solutions for mobility Tata Motors strategic focus places it at the forefront in the electric vehicle revolution, and reflects the company commitment to customer satisfaction and innovation

Jaguar Land Rover Financial Recovery

In the company annual report Chairman N Chandrasekaran noted that after a turbulent three year period marked by disruptions in supply chains inflation energy crises and global instability Jaguar Land Rover has triumphantly returned to financial health JLR has now set the stage for its next chapter in the Reimagine which aims to position the company as the premier manufacturer of luxury electrical vehicles (EVs) This strategic shift highlights JLR commitment towards innovation and leadership within the rapidly changing automotive landscape

House of Brands Strategy

JLR launched a new House of Brands a strategy that is innovative and redesigned corporate identity to help it achieve its vision of being proud modern luxury creators In FY24 the business achieved remarkable results with a 27% increase in revenue to PS29 billion Profit before taxes (excluding exceptional items) reached an impressive PS2.2billion and free cash flow also soared to a new record PS2.3billion This revival highlights JLR ability to grow and adapt in a difficult market

Focus on electric vehicles

JLR launched its first electric vehicle (EV) in FY24 The Jaguar I PACE set the stage for future models The company plans to introduce six new electric cars by FY26 Each vehicle will be equipped with software defined capabilities that are designed to improve performance and the user experience This ambitious strategy is in line with global trends toward sustainable mobility and positions JLR to be a key player on the luxury EV markets

JLR: Transforming its Operations

JLR management is also committed to transform its operations They are focusing on electrification and improving operating margins The company vision is to become a technology-driven brand It actively explores innovative solutions and embraces cutting edge technologies in order to enhance product offerings and improve customer experiences

Financial Health and Operational Resistance

JLR operational resilience has been demonstrated by its ability navigate a turbulent landscape with sustainability as the core of its strategic approach JLR is well positioned to take advantage of the increasing demand for luxury electric cars as the automotive industry continues to evolve It leverages its rich heritage and embraces the future

Strategic Investment for Long-Term Development

Chandrasekaran emphasized the importance of investing in research and development and sustainable practices as key components of Tata Motors long term strategy for growth Tata Motors wants to cement its position as the leader of the global automotive industry by fostering innovation building strong partnerships and focusing on delivering value for stakeholders

Final Remarks

Tata Motors in conclusion is well-positioned to navigate through the complexity of the global automotive industry with innovation and resilience The company commitment to sustainability and its strategic focus on electric cars along with its robust performance in all divisions makes it well positioned to take advantage of the new market dynamics Tata Motors under the leadership of N Chandrasekaran is poised to redefine the future mobility of the company driving growth and creating value for customers and stakeholders

Frequently Ask Question

Which strategy makes Tata Motors more profitable for car than Maruti?

Tata Motors is known for its electric cars and SUVs as well as Jaguar Land Rover’s strong performance Tata Motors market value of Rs 314.635 crores is Rs 1576 crores higher than Maruti valuation of R 313.059 crores 4 February 2024

Why is Tata Motors a good investment?

Positive Indicators Tata Motors revenue and profit growth is driven by JLR which positions it for future growth The company commitment to expanding its range of luxury and electric vehicles will further improve its prospects

Is Maruti a good investment?

Maruti Suzuki India TTM P/E is 2573 compared with the sector P/E which is 2571 Maruti Suzuki India has been covered by 39 analysts 14 analysts have given the stock a strong buy rating and 10 analysts have given a buy rating Two analysts have given it a sell recommendation

What is the total investment of Maruti Suzuki company?

Maruti Suzuki

| Formerly | Maruti Udyog Limited |

|---|---|

| Total Assets | Rs115353 Crore (US$14 Billion) (2024) |

| Total equity | Rs85.636 crore (10 billion dollars) |

| Number of employees | 40004 (including 21776 non permanent) (2024) |

| Parents | Suzuki Motor Corporation |